TraderMetrics Newsletter Number 1

December 8th, 2006

Hi and welcome to the first edition of the TraderMetrics Newsletter.

We hope to bring you a regular issue with tips and tricks, offers and news about TraderMetrics, the forex simulation.

First of all, a special offer to those who have not purchased a copy of TraderMetrics (although those who have bought will also benefit!):

We have prepared an alternative evaluation file for you. This is a 4 hour file based on the EUR/USD with plenty of action and news items. Your task is to interpret the news items and trade accordingly. There are a few chart patterns and quite a range!

The files required are in a zip file which can be downloaded from the dadfiles library page. The file is called 'alternateeval.zip'. To install the files, first rename the existing evaluation file (located in the \TraderMetrics\dadfiles\EvalDemo directory) to something else (such as evaldemoold.dad).

You then start up TraderMetrics. If you have a license already, enter '1234' as the password.

Gaming Plans

We are in contact with interested parties who would like to offer TraderMetrics as an alternative to on-line poker. If this happens, then there is the prospect of serious money to be won! You have probably heard of the amounts being wagered in on-line poker and we think that virtual forex trading has the same potential and requires skill as well as some luck.

The great thing about running a closed group session with TraderMetrics is that the rules can be created along the way to suit making it a game. There are many variations possible, and I would like to give you an example.

In TraderMetrics, there is a mechanism to drive a 'virtual market', called 'Autotransact'. This is where virtual customers can deal on your price, without asking for a quote. In other words, you supply them with a streaming quote. Of course, you can intervene and cut the amounts down, or even turn the orders off altogether.

In the stand-alone session, the autotransact does not influence the price. That is driven either by live rates from the Internet or by 'canned' rates. In a network session, however, we can create real market movements generated by supply and demand.

By allowing the 'central bank' at the server to support the market, we can supply liquidity to the market. We can set the market price to change when a certain amount is done at a price. For example, if we set the price to change 1 point for every 2 million, then a 10 million order hitting the market will change the price 5 points. That means that if the price was 35-38 and there was a 10 million sell order, the price would move to 30-33.

Unless there was some support from the traders in the market!

Ok, this is where the fun begins! There are 'robot' traders logged on to the server that literally dump every order they have in the market, producing very interesting results. The graphs of such sessions look absolutely authentic.

If you are a trader logged into such a session, you will have to 'turn' the orders that you get in the market and at the same time, be aware of what is going on. Especially if you are market maker. In this case, you will be calling other traders and will be called yourself for prices.

Within a quote, there is a world of information: You would tend to quote 'into' your position. For example, the market is 30-35, and you have just been given 10 million from a 'BBB' customer at 30. You would want to quote a better offer (ask) than the market - enough to perhaps interest the other party, but not so much that you tell him that you are 'long'!

His response also gives information! If you were aggressive and quoted 27-32 and he did nothing, you can assume he is also long. Advice: Sell at the market (30) before he, or any of the other traders get the idea that the customers have been out selling.

If you are a very aggressive market maker, you will often be the first to know that something is going on. If you quote 2 points in a 5 point market, you will have many calls coming in, so if you are quick enough, you can be a 'leader' instead of a 'follower'.

Additionally, if you quote 'tight' prices, you should be getting 'reciprocation', that is, similar spreads back from those you call.

You see, it is all in the price - but the electronic broker does not always tell the truth. Maybe someone is spoofing the market.

As I said, there are several variations. A more extreme version is where the direction of the market is dictated by a random mechanism, so the balance of the customer trades are in one direction. That is all the customers. So you have to get a 'feel' if the customer who just sold you 10 million is out there popping everybody for 10 on the same side.

Pass the Parcel - forex style!

Now we come to the 'rules'. One of them is that you are penalised if you break your position limit. In an extreme situation, you might only have 'AAA' customers who are aloud to trade on the middle price. That is, if the market is 50-60, they deal at 55! These are your prime customers and they get this 'service' because they give your bank so much other business!

If your position limit is 10 million and the maximum customer trade is 10 million, you will have to 'dump' the position immediately, if you are given or taken in 10. Otherwise, you risk getting 'stopped out' for the amount over 10 million at the market.

If a customer gave you 10 million at 55 and you became long of 20 million as a result, the 10 million will be stopped out at 50 - a loss of 50 points.

If we assume that we are playing a 'winner takes all' game, this is bad news. On the other hand, what a way to show your forex trading skills! Pay in a modest amount (say $10) and join a session with 1000 other traders. If you are good enough, you could walk away with over $4,000!

Good enough reason to start practicing now! We hope to be getting some practice trading sessions going in the near future. We would run competitions ourselves, but unfortunately , Denmark has such Draconian gambling laws that we cannot do this.

As I said, we are talking to companies offshore who can.

Forum

We are launching a forum soon, where all aspects of TraderMetrics and trading can be discussed. We will keep you informed.

Getting your head around all the features

Though you can improve your trading skills immensely with TraderMetrics, it can be daunting the first few times that you use it. Especially all the information. The interface is probably different to what you may be used to with some trading platforms.

Transacting business.

What may be confusing is not being able to use the electronic broker in the margin trading interface. This is because streaming prices for retail investors is a relatively new thing!

So let us start with asking for a quote. In this case, when you wish to make a trade, you have to enter into a 'conversation' with the broker. This is done by contacting the broker and asking for a price.

In margin trading mode, you cannot call out for a specific amount. There is just one 'call out' button available

Alternatively, you can call out from the menu.

When the call has been accepted by the broker, you will see the icon flashing at the bottom of the screen and also a message in the Information window. Click on either.

You will see the call waiting window. Click in the white area to open the conversation.

When the window is open (and remember, you have a limited time to respond), you will see a price quoted by the broker.

If you don't react, the price will be taken off and you will be asked to call again when you want a new price.

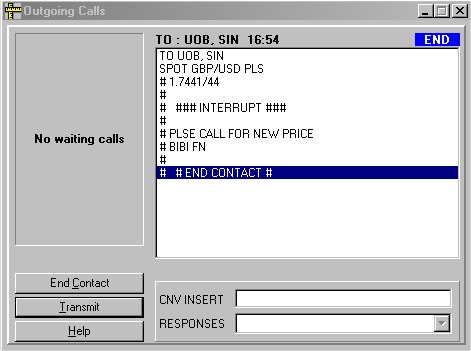

If you call again with the call window still active, you will get this message.TIP: End the call by clicking on the 'End Contact' button.

When the quote is made, you have a choice of action to take, dictated by the items in the drop-down 'CNV INSERT' box. These are: to buy, to sell, or do nothing.

If you select 'buy' or 'sell', you have to enter an amount which must be within your trading limits. Click the 'Transmit' button as soon as you have chosen an action.

After transmitting, the broker will confirm the trade, with the rate, value date and instructions. Information that you don't normally see from your broker!

If you do try and trade for a larger amount than your margin account allows, you will get a message like this. You will have to call again for a price.

Keep an eye on the positions information, especially your margin levels.

Short History of TraderMetrics

The simulation was developed to teach the then new traders from Central and Eastern Europe to trade. It was very successful, also with western banks. The software was developed with sophisticated statistics, which initially were designed for the benefit of the trainer. Trainee traders began to use the tools as decision support, which led to the development of a 'Real Time' program. An Internet version was developed as well.

In 2000, the company that developed TraderMetrics was sold to SimCorp, a leading financial software company. This summer, Steve Pickering, the designer of the system, was asked by SimCorp if he wanted to repurchase the rights, which he agreed to.

Although the software commanded a high price when it was sold exclusively to financial institutions, it was decided to offer it to retail investors at an affordable price.

As you can appreciate, a lot of thought went into this very complex system. The standard of programming is very high and the software has been the basis for a well-known broker trading platform. We are very proud to be able to offer you this software and trust that you will benefit as much as the Interbank traders who have been trained using it.

Remember that if you have not yet purchase TraderMetrics, you can do so by sending us the Product Identification Code from the Help>Registration Information menu item and clicking on the link.

The information contained herein is

not

intended to be, and should not be construed as, a recommendation

regardingany potential purchase of an investment or the rendering of risk

or investment advice. Trading in foreign exchange is a

business

associated with risk and by entering the site you acknowledge

and agree to

be fully liable for any actions or investment

decisions you make in

connection with this newsletter or any linked

site.

Link to Forex Trader Mentor web site